India’s export sector in 2025 offers vast opportunities across various industries. With supportive government policies, digital advancements, and global market access, Indian exporters are well-positioned to expand their reach. This guide provides a step-by-step approach to initiating and scaling your export business from India.

Establishing Your Export Business

a. Legal Entity Formation

- Choose an appropriate business structure:

- Sole Proprietorship

- Partnership Firm

- Limited Liability Partnership (LLP)

- Private Limited Company

- Sole Proprietorship

- Register your business with the Ministry of Corporate Affairs (MCA).

b. Bank Account Opening

- Open a current account with a bank authorized to deal in foreign exchange.

- This account will handle all export-related transactions.

c. Permanent Account Number (PAN)

- Apply for a PAN from the Income Tax Department.

- A PAN is essential for financial and tax-related activities.

d. Importer Exporter Code (IEC)

- Obtain an IEC from the Directorate General of Foreign Trade (DGFT).

- This unique 10-digit code is mandatory for all export-import activities.

Understanding Export Documentation

Accurate documentation ensures smooth export operations.

a. Mandatory Documents

- Commercial Invoice cum Packing List: Details of goods, quantity, and value.

- Shipping Bill/Bill of Export: Primary customs document for export clearance.

- Bill of Lading/Airway Bill: Proof of shipment issued by the carrier.

- Certificate of Origin: Indicates the origin of goods required to avail of trade benefits.

- Export Declaration Form (EDF): Declaration of export value and terms.

b. Additional Certifications

- Product-specific certificates (e.g., Phytosanitary, Fumigation) may be required based on the nature of goods and the destination country

Navigating Export Procedures

a. Product Classification

- Classify your products under the correct ITC (HS) codes to determine applicable duties and regulations.

b. Compliance with Export Policies

- Familiarize yourself with the Foreign Trade Policy (FTP) 2023-2028, which outlines export incentives, procedures, and compliance requirements.

c. Logistics and Shipping

- Choose suitable logistics partners and understand Incoterms to define responsibilities and risks during transportation.

d. Customs Clearance

- Engage with customs brokers to facilitate clearance processes and ensure adherence to customs regulations.

Leveraging Government Export Incentives

The Indian government offers various schemes to promote exports:

Scheme | Description |

Remission of Duties and Taxes on Exported Products (RoDTEP) | It provides reimbursement for embedded taxes and duties not refunded under other schemes. As of June 1, 2025, RoDTEP benefits have been reinstated for exporters under Advance Authorization, Export Oriented Units (EOUs), and Special Economic Zones (SEZs). |

Export Promotion Capital Goods (EPCG) Scheme | Allows import of capital goods at zero customs duty, subject to export obligations. |

Refunds of customs duties paid on imported inputs used in manufacturing exported goods. | |

Advance Authorization Scheme | Permits the duty-free import of inputs required for export production. |

Interest Equalisation Scheme (IES) | Provides interest subsidies on pre- and post-shipment export credit to eligible exporters. |

Engaging with Export Promotion Councils (EPCs)

EPCs play a pivotal role in supporting exporters:

- Apparel Export Promotion Council (AEPC)

- Pharmaceuticals Export Promotion Council (Pharmexcil)

- Engineering Export Promotion Council (EEPC)

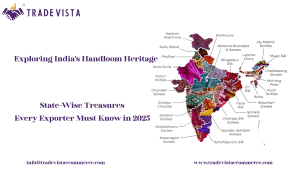

- Handloom Export Promotion Council (HEPC)

- Gem & Jewellery Export Promotion Council (GJEPC)

These councils offer market intelligence, policy advocacy, and facilitate participation in international trade fairs.

Exploring International Markets

a. Identifying Target Markets

- Utilize trade statistics and market research to pinpoint countries with demand for your products.

b. Understanding Trade Agreements

- Leverage Free Trade Agreements (FTAs) and Preferential Trade Agreements (PTAs) to gain tariff advantages.

c. Adhering to International Standards

- Ensure compliance with international quality and safety standards to meet buyer requirements.

Utilizing Digital B2B Platforms: Alibaba.com

Expanding your reach through B2B platforms like Alibaba.com can be highly beneficial:

- Global Exposure: Access to a vast network of international buyers.

- Verified Buyer Leads: Connect with authenticated importers seeking products from India.

- Trade Assurance: Secure transactions with payment protection and dispute resolution.

- Marketing Tools: Utilize platform tools to showcase products and manage inquiries.

By listing your products on Alibaba.com, you can tap into new markets and streamline your export operations.

Banking and Financial Regulations

a. Foreign Exchange Management

- Comply with the Foreign Exchange Management Act (FEMA) regulations governing cross-border transactions.

b. Realization and Repatriation of Export Proceeds

- Ensure timely realization of export payments and repatriation of foreign exchange earnings.

c. Export Credit and Insurance

- For credit insurance and risk mitigation, engage with institutions like the Export Credit Guarantee Corporation of India (ECGC).

Embarking on the export journey from India in 2025 offers immense potential across diverse sectors. Exporters can effectively navigate the global marketplace by adhering to regulatory requirements, leveraging government incentives, engaging with EPCs, and utilizing digital platforms like Alibaba.com.

Consult with export professionals or contact relevant export promotion councils for personalized guidance and support.

Note: This guide is based on information available as of June 2025. Exporters should consult official sources and professionals for current regulations and procedures.