What is a Letter of Credit?

A Letter of Credit (LC) is a document that guarantees the buyer’s payment to the sellers. A bank issues it and ensures timely and full payment to the seller. If the buyer cannot make such a payment, the bank covers the full or the remaining amount on behalf of the buyer.

As a trade finance tool, Letters of Credit are designed to protect both exporters and importers. They can help you win business with new clients in foreign markets. This means the exporter gets a payment guarantee while the importer is offered reasonable payment terms.

What is LC in Export?

Think of an LC (Letter of Credit) as a bank’s promise on behalf of the buyer (importer) to the seller (exporter).

If we were to put it plainly, a Letter of Credit is a legal document issued by a bank that guarantees the seller will receive payment from the buyer’s bank if the seller fulfils all specified terms of the agreement.

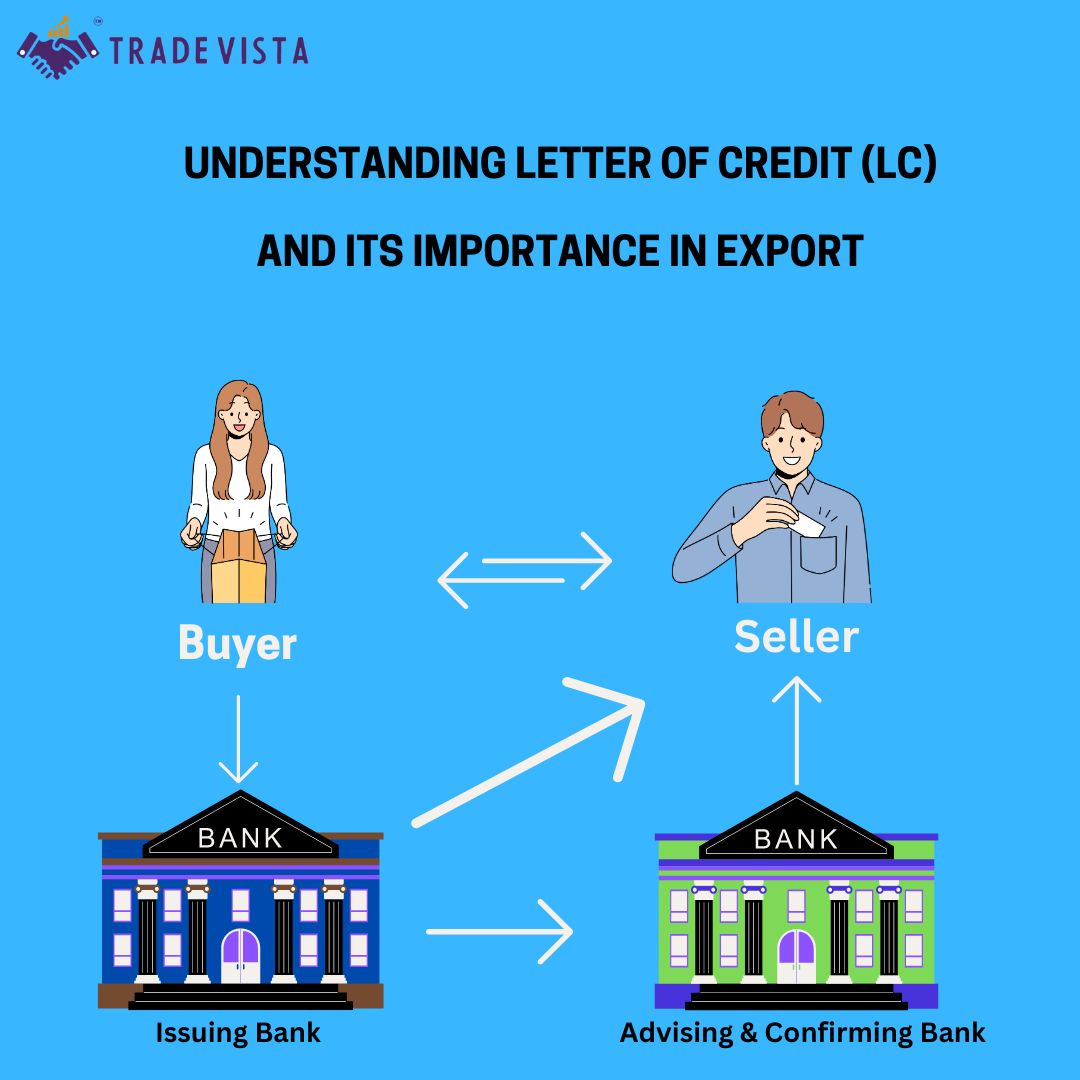

Who are the parties to a Letter of Credit?

- Applicant (importer) requests the bank to issue the LC.

- Issuing bank (importer’s bank which issues the LC [also known as the Opening banker of LC]).

- Beneficiary (exporter).

What are the Types of Letters of Credit?

While people often ask about this, they must also understand that different types of LCs exist. We have explored the key types below.

Irrevocable LC

This standard form of LC cannot be amended or cancelled without all parties’ consent. It provides a strong assurance of payment, making it a preferred choice for international transactions.

Revocable LC

Unlike the irrevocable LC, the issuer can alter or nullify this type without needing the beneficiary’s consent. Due to its less secure nature, it’s rarely used in international trade.

Confirmed LC

It offers an additional layer of security to the seller. Alongside the issuing bank’s promise to pay, a confirming bank in the seller’s country also guarantees payment under the LC.

Unconfirmed LC

In this case, only the issuing bank guarantees payment. The seller takes on the risk associated with the reliability of the foreign bank.

Sight LC

This LC requires the bank to pay the beneficiary immediately upon presenting and verifying the documents stipulated in the LC.

Usance (or Time) LC

It allows for a deferred payment, giving the buyer a set period after the document presentation to make the payment.

What is the List of all documents required for an LC?

The list of documents required for the Letter of Credit:

- Commercial invoice: Details the sale transaction and pricing

- Bill of lading: A receipt for shipped goods and a carriage contract

- Insurance documents: Confirm that the shipment is insured against loss or damage

- Packing list: Provides details about the contents of the shipment.

- Certificate of origin: Verifies the country in which the goods were produced

- Inspection certificate: May be required to prove that goods were inspected and meet quality standards

How to Apply for a Letter of Credit?

To apply for the Letter of Credit for Export purposes, follow the below steps:

- The exporter and their bank must be satisfied with the creditworthiness of the importer’s bank. Once the Sales Agreement is completed, the importer applies to their bank to open a Letter of Credit in favour of the exporter.

- The Importer’s bank drafts the Letter of Credit using the Sales Agreement terms and conditions and transmits it to the exporter’s bank. The exporter’s bank reviews and approves the Letter of Credit and sends it to the exporter.

- The exporter ships the goods in the manner provided for in the letter of credit and submits the required documents to their bank. A freight forwarder may assist in this process.

- The Exporter’s bank checks the documents for compliance with the Letter of Credit terms and conditions. Any document errors and discrepancies must be amended and resubmitted. After approval, the exporter’s bank submits the complying documents to the importer’s bank.

- The importer’s bank releases payment to the exporter’s bank. The importer’s account is where their bank releases the documents to the importer to claim the goods and clear customs.

What are the Fees Associated with an LC?

Here is the list of fees associated with the Letter of Credit:

- Issuance fee: Charged by the issuing bank to set up the LC, usually a percentage of the LC amount

- Advisory fee: Levied by the advising bank for notifying the beneficiary about the LC, which may vary depending on the bank and the complexity of the transaction

- Negotiation fee: Incurred when the beneficiary’s bank checks the documents for compliance with the LC terms before payment

- Confirmation fee: Applied if the beneficiary requests the advising bank to add its confirmation to the LC, offering an additional layer of security

- Amendment fee: Charged for any changes to the LC terms after issuance, excluding cancellation or extension fees, which may be assessed separately

- Courier and communication fees: Cover the costs of sending documents and correspondence between the involved banks and parties

Alibaba.com Membership | Tridge Membership | Import/Export Documentation & Compliance | Government Scheme | Logistic | Import/Export Consultation |

FAQs for Letter of Credit

What type of collateral is required to open a letter of credit?

The bank issuing the letter of credit will require collateral, such as a fixed deposit, depending on the strength of the applicant’s finances. The bank decides to enter into a transaction according to a set of criteria.

Can an LC be cancelled?

Yes, but it depends on the type of LC. Revocable LCs can be amended or cancelled by the issuing bank without prior notice to the beneficiary. However, irrevocable LCs cannot be cancelled or amended without the agreement of all parties, including the beneficiary.

What responsibility does the buyer’s bank have?

The buyer’s bank, or the issuing bank, is responsible for paying the seller as long as the terms of the LC are met. Before releasing funds, the bank must examine all documents to ensure they comply with the LC terms.

What are the Benefits for Sellers in International Trade?

Some of the benefits for sellers in international trade are:

Guaranteed payment: Upon fulfilling the agreed terms, sellers are assured of their payment, reducing the risk of non-payment

Enhanced creditworthiness: Sellers can undertake more significant transactions with confidence, knowing the bank guarantees payment

Improved working capital management: With payment assurances, exporters can better predict their cash flow, aiding in smoother operation management

What are the benefits for buyers of international trade?

Assured quality and timeliness: Payment is only made if the sellers meet the specific conditions of the LC, including quality and delivery timelines

Financial flexibility: Buyers can negotiate better terms, such as more extended payment periods, improving cash flow